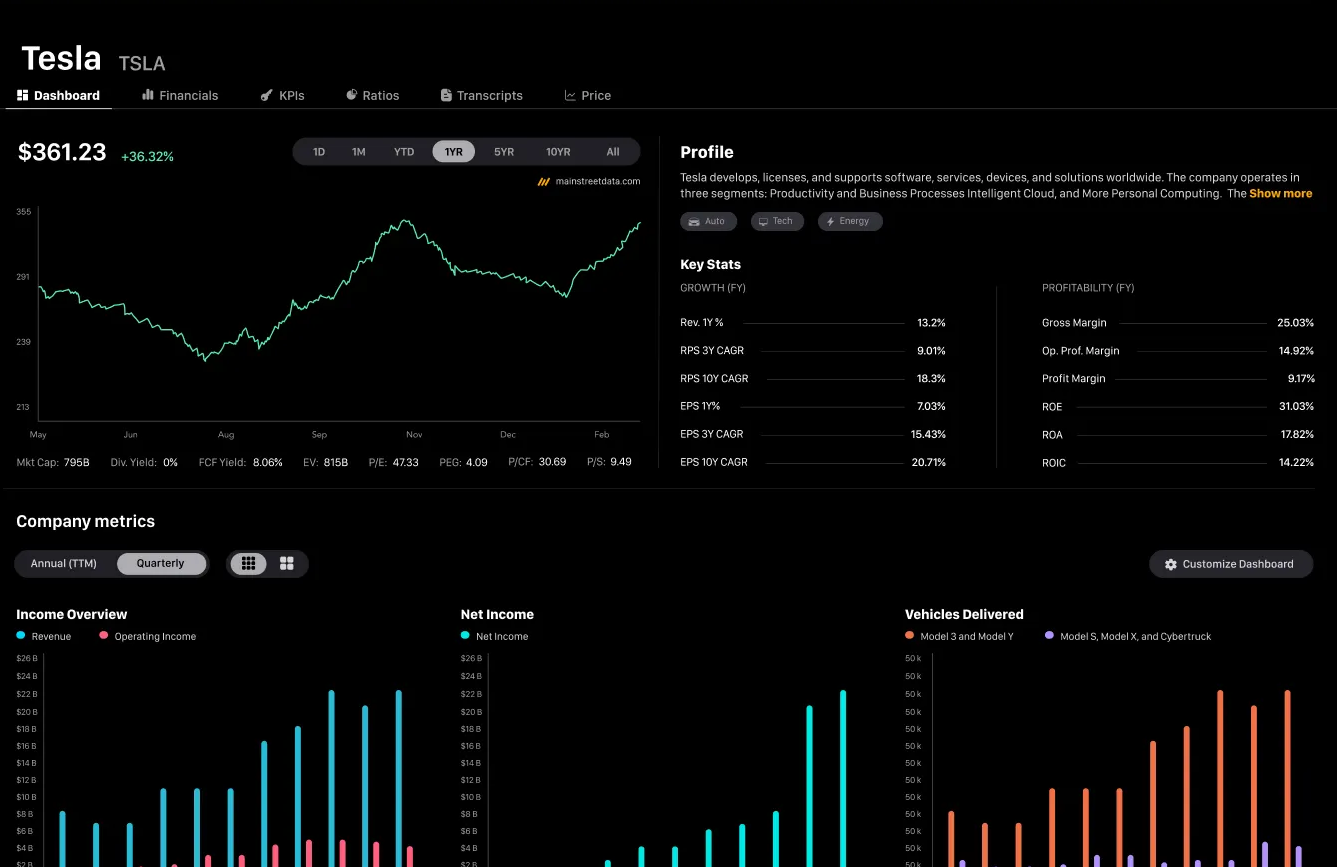

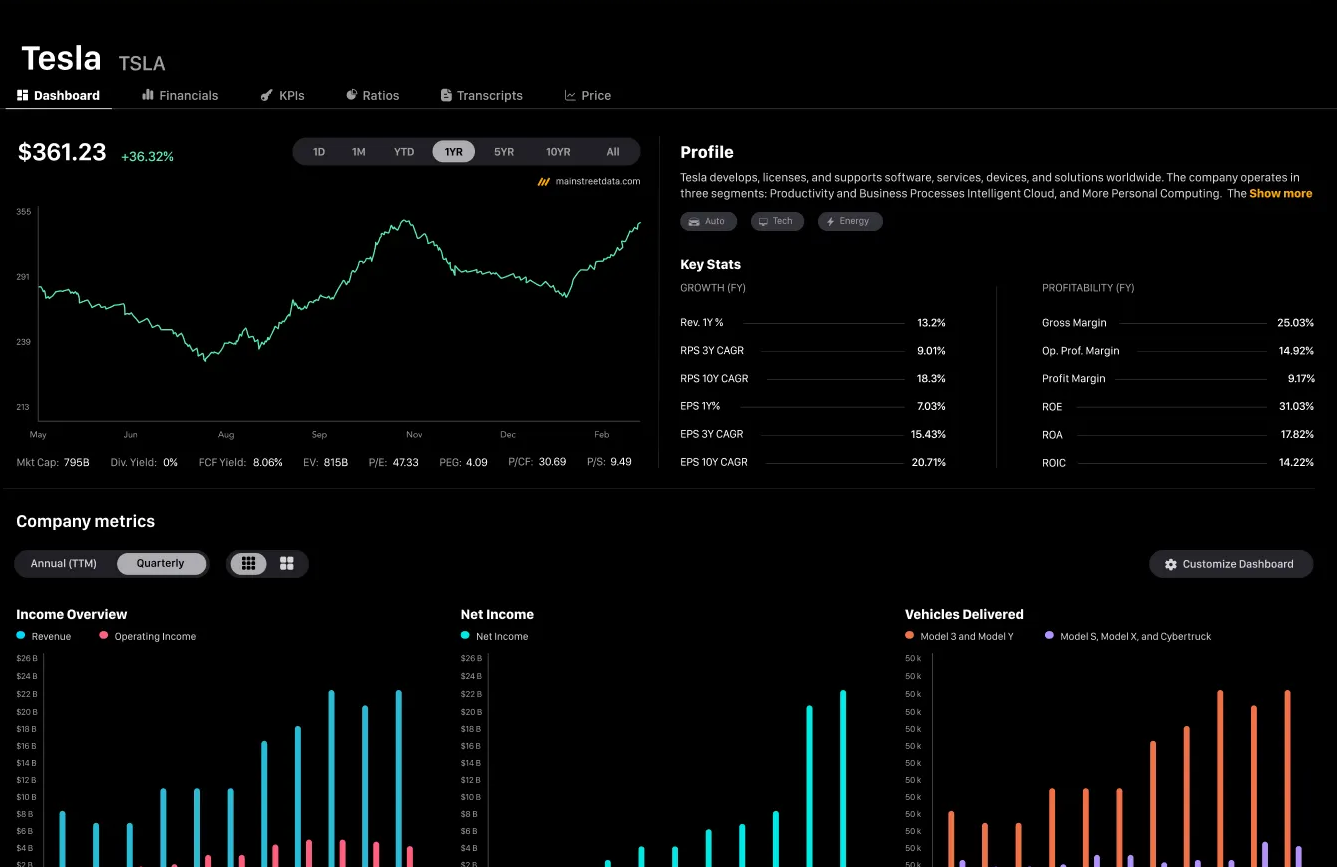

We Beat the S&P 500 by 23.0% Using Advanced AI

Miraus is a value-investing engine using AI to analyze millions of financial data points and macro factors, simulating future scenarios. This creates a dynamic map of intrinsic value, identifying cash-generating assets which are traded at a discount.

Investment Philosophy — Economics Over Sentiment

"All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies."

BERKSHIRE HATHAWAY INC.Warren BuffettChairman & CEO, Berkshire Hathaway

We prioritize business economics—cash flows, returns on capital, balance‑sheet strength—over short‑term market noise.

Miraus seeks under‑valued companies with strong financials and durable moats, and sizes positions within a risk‑managed fund mandate.

Miraus vs. S&P 500 index

Results Speak

vs +19.3%

Annual Return

vs 1.34

Sharpe Ratio

vs -7.6%

Max Drawdown

Deep Fundamentals × Macro Intelligence

Quality data, value discipline, macro context.

Multi‑source institutional data: Miraus ingests standardized datasets from leading providers (e.g., S&P Global, LSEG/Refinitiv, Bloomberg*) and parses historical financial statements (cash flow, income statement, balance sheet, and notes where available).

Business economics first: In the spirit of value investing, we seek durable businesses with attractive unit economics and a margin of safety relative to intrinsic value.

Macro overlay: Interest rates, inflation regimes, credit spreads, yield curve shape, FX, and commodity signals inform expected returns, risk, and hedging across the cycle.

Interest Rates

Revenue

Debt

CAPEX

Institutional Flow Intelligence

Enter when the smart money does.

Follow the capital: Miraus identifies where large institutional investors are establishing significant positions, allowing you to align with the market's most informed participants rather than trade against them.

Precision timing: Our proprietary pattern recognition detects structural inflection points in price action — moments when institutional accumulation or distribution creates favorable entry and exit opportunities.

Asymmetric positioning: By monitoring the footprints of banks, hedge funds, and asset managers, we capture moves with statistically favorable risk/reward profiles — seeking larger gains relative to downside exposure.

Risk‑Managed Asset Allocation

Your edge is the mix — managed to a risk budget.

Risk‑budgeted: The fund targets a defined volatility/drawdown range to balance growth and protection.

Constraint‑aware: Respect guardrails (max single‑name weights, sector caps, cash floors) to manage concentration risk.

Scenario‑tested: Portfolios are stress‑tested across historical and simulated regimes (rate shocks, recessions, inflation spikes).

Dynamic rebalancing: Adjusts when risk/return changes, not just on a calendar.

Global Opportunity Set

Go where the value is.

Coverage includes major markets beyond the U.S. — Canada, U.K., Germany, France, China, and more as data quality permits. Broader opportunity = more chances to find quality businesses at attractive prices.

Company logos are shown for illustrative purposes only. Logo usage complies with trademark guidelines. Investment opportunities may vary based on data availability and market conditions.

Frequently Asked Questions

Essential information for Miraus.ai hedge fund prospects about fund structure, fees, liquidity, and strategy implementation.